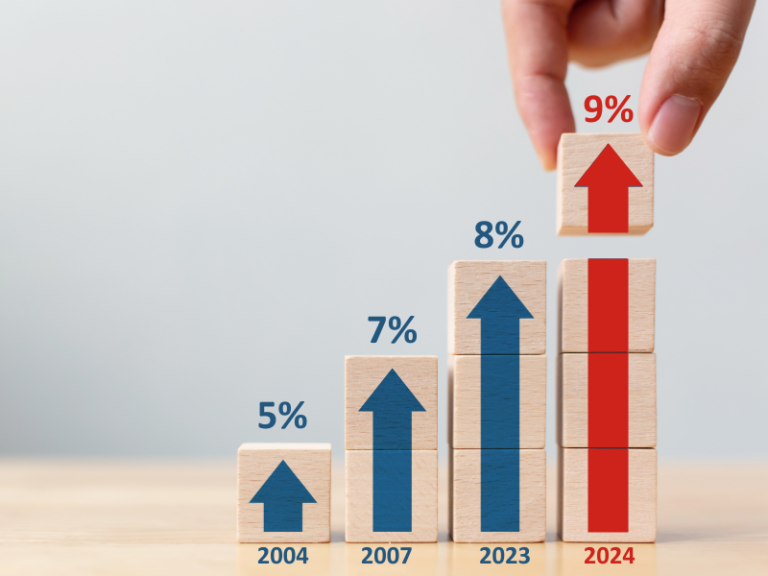

Will Singapore’s New 9% GST In 2024 Affect Loan Interest Rates?

With Singapore bracing for a prospective uptick in the Goods and Services Tax (GST) to 9% by 2024, the financial landscape is a topic of concern for many locals. Among the uncertainties lies the question of how this change might reverberate through personal loan interest rates. This article delves into the correlation between the impending GST hike and loan interest rates in Singapore, offering insights into what borrowers can anticipate and how they can navigate financial decisions more effectively.

How Does GST Impact Interest Rates?

The Goods and Services Tax (GST) functions as a consumption tax applicable to the sale of goods and services in Singapore. Its fluctuations possess the potential to cast a ripple effect on the overall cost of living, thereby influencing economic elements that contribute to the determination of loan interest rates.

Inflationary Pressures:

- An escalation in GST has the potential to instigate inflationary pressures on the economy. Elevated prices for goods and services may contribute to a general upswing in the cost of living.

Impact on Borrowing Costs:

- As inflationary pressures surge, the cost of borrowing may experience an uptick. This has the potential to influence personal loan interest rates, necessitating borrowers to stay abreast of market trends.

MAS Policies:

- The Monetary Authority of Singapore (MAS) plays a pivotal role in shaping interest rate policies. Adjustments in GST can sway the MAS’s decisions aimed at upholding economic stability, thereby affecting the trajectory of personal loan interest rates.

Strategic Positioning of Financial Institutions:

- Financial institutions, including banks, strategically evaluate their competitive positioning in tandem with monetary measures and policies. The decisions of the Monetary Authority of Singapore on interest rates can significantly impact the borrowing costs of financial institutions, subsequently shaping their strategic choices concerning adjustments to interest rates for personal loans.

Navigating the intricate effects of an increasing GST on loan interest rates is a nuanced task, contingent on diverse economic elements. However, maintaining awareness and taking a proactive stance are paramount. FUNDREGO offers a solution by enabling you to compare interest rates across numerous banks and loan providers. This empowers you to identify the most suitable rates that align with your financial objectives for 2024.

Apply your loan with FUNDREGO today!